Having a successful business and being able to travel the world at one’s leisure used to be two entirely separate goals. But as today’s economy becomes more digitally oriented, it’s now possible to do both at the same time without the stresses of one eating into the other.

Thanks to digital solutions like e-commerce platforms and online payment systems, entrepreneurs are now free to pursue other passions—like jet-setting around their countries or around the globe—without disrupting their business operations.

This article explores how online payment solutions can empower Filipino entrepreneurs and digital nomads to run their small- to medium-sized businesses (SME) while embracing a nomadic, globe-trotting lifestyle.

The Benefits of Online Payment Solutions for Traveling Entrepreneurs and Digital Nomads

One of the most challenging aspects of running a business is getting paid on time by one’s customers or clients. Those who are well acquainted with the entrepreneurial lifestyle know how difficult this can sometimes be, even when all parties share the same location or time zone.

But over the past decade, various online payment solutions have been developed to minimize friction during the payment process. This makes it easier for customers and clients to settle payments from anywhere, at any time. Here are some of the advantages that traveling entrepreneurs and digital nomads enjoy as a result:

Flexibility and Convenience

Online payment solutions offer unparalleled flexibility and convenience for both entrepreneurs and their customers. Solutions like payment links allow entrepreneurs to conduct business transactions and accept payments on a round-the-clock basis, and from various channels.

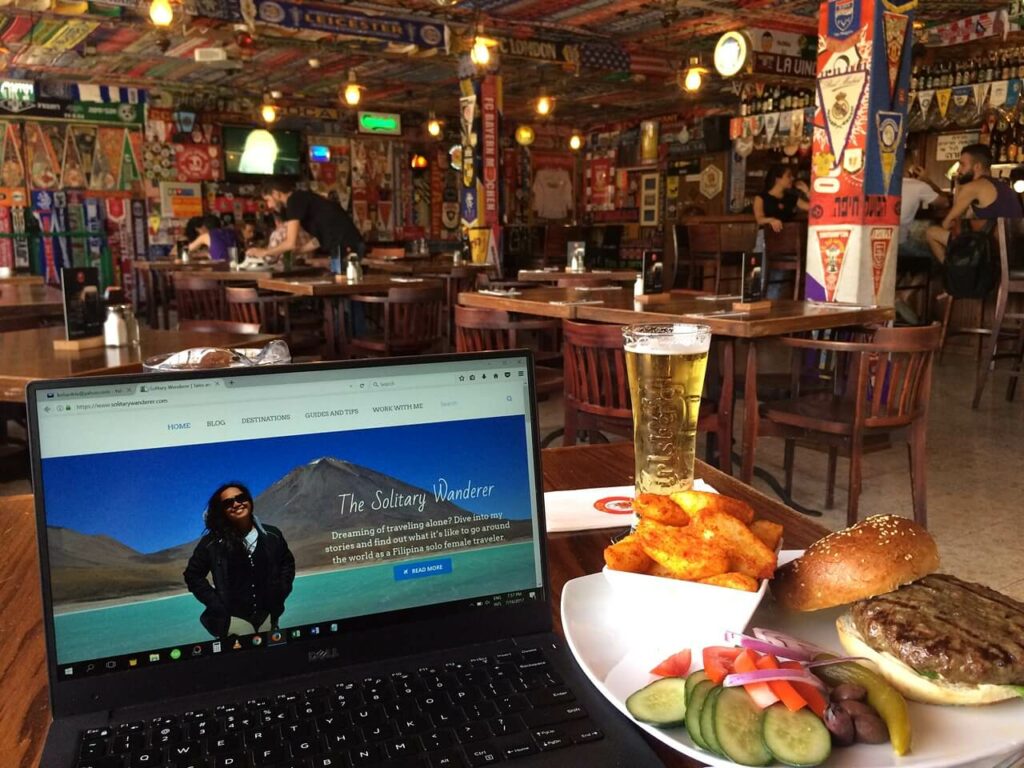

Whether they’re working from a beachside café in Bali or a bustling co-working space in Chiang Mai, Filipino business owners who are away on travel can oversee any link payment from customers and clients via messaging apps.

Meanwhile, the customer can choose their preferred payment method, ranging from traditional credit cards to popular contemporary digital wallets. Indeed, this method of payment benefits not just the entrepreneur who’s on a working holiday, but the paying customer who wants to give them business.

Seamless and Secure Transactions

Another great advantage that comes with today’s online payment solutions is the ability to accept payments securely, regardless of the entrepreneur’s physical location. These solutions provide secure payment gateways and robust protection measures against fraud and other forms of financial crime, ensuring the safety of financial transactions.

As such, Filipino entrepreneurs can focus on growing their businesses with peace of mind, even from a distance. That’s because they know that their customers’ payments will be processed smoothly and securely.

Global Accessibility and Expansion

The ability to use online payment solutions also means less trouble with geographical barriers, which allows Filipino entrepreneurs and digital nomads to expand their businesses globally. Thanks to digital innovations like these, businesses can cater to international clients and tap into new markets without the need to stay in any one location.

Your own dream of global expansion as a traveling entrepreneur will be well within reach, now that you can accept payments in different currencies while also offering different payment methods to international customers. Grow your ambitions of owning a global business while also traveling across the globe yourself.

Real-time Tracking and Financial Management

Regardless of where a business is based and how it operates, an entrepreneur always needs to stay on top of their finances. Today’s online payment solutions provide traveling digital nomads with real-time tracking and financial management capabilities at the snap of a finger.

It won’t be hard for entrepreneurs to monitor transactions, track expenses, and analyze sales data on the go. With access to accurate, comprehensive, and up-to-date insights into their financial performance, entrepreneurs can make informed decisions, improve their business strategies, and ensure financial stability for the SMEs they lead even if they’re far away from their headquarters.

What Are the Different Online Payment Methods Available to Digital Nomads and Traveling Entrepreneurs?

Innovations in the finance sector continue to evolve at a rapid pace, giving rise to new cashless payment methods. Some of the ones you can expect to encounter if you’re a digital nomad or traveling entrepreneur are the following:

Online Payment Link

Payment links allow businesses to send customized payment requests to customers, even without a website. Entrepreneurs can use popular messaging apps like Messenger, Viber, or Telegram to send a URL link for payment.

With a simple click, customers can make payments in an instant, eliminating their need to manually input their payment details. Payment links are especially useful for invoicing, one-time payments, and payments for service-based businesses.

Payment Gateways

Payment gateways serve as intermediaries between businesses and customers and are responsible for securely processing online payments. They facilitate transactions by encrypting sensitive data and providing a seamless payment experience.

Currently, one of the most popular payment gateway options available to Filipino entrepreneurs and digital nomads is that of Maya Business.

Bank Transfers

Bank transfers enable the direct transfer of funds between customers and businesses. Through this method, customers can initiate payments through online banking or mobile banking apps.

Bank transfers remain a convenient and secure way for traveling entrepreneurs or digital nomads to receive payments from customers back home, particularly for larger transactions or recurring payments.

Invoice Payments

Online invoicing systems streamline the payment process for Filipino entrepreneurs. These solutions generate professional invoices, track payment statuses, and send automated payment reminders. What’s more, they provide a systematic approach to invoicing and payment management, saving time and ensuring prompt settlement of payment.

The structure of an online invoicing system will serve a traveling entrepreneur or digital nomad very well, especially if they’re jet-setting from different time zones and find it harder than usual to keep abreast of business finances.

Digital Wallets

Digital wallets have gained popularity in the Philippines because they provide a convenient and secure way to make payments. Services like Maya allow users to store funds digitally and make payments through mobile apps. They offer contactless transactions, enabling quick and hassle-free payments for customers and businesses alike.

Knowing that many of your customers back home will want to pay you through their e-wallets, make sure that this payment option is readily available before your next trip abroad.

Other Solutions

There are also numerous other online payment solutions that cater to the specific needs of digital nomads and traveling entrepreneurs. These include industry-specific payment platforms, peer-to-peer payment apps, or cryptocurrency payment gateways.

It’s important to explore and choose solutions that align with your business requirements and target market, as well as to make sure that they’re easy to use when you’re away.

Takeaway

There’s no doubt that online payment solutions have transformed the way entrepreneurs and digital nomads run their businesses remotely. They help entrepreneurs reach their business goals, even while the former are traveling, and actively contribute towards business growth and customer satisfaction.

As more aspiring entrepreneurs and digital nomads venture into the world of remote business, online payment solutions are sure to help them thrive in this flexible and freeing new lifestyle. If this applies to your own dreams of seeing the world while running your own business, be sure to check out the payment solutions listed above.