Each year, the TIAA Institute and Global Financial Literacy Excellence Center (GFLEC) conducts a survey of adults to determine their overall financial literacy. The average score on their test of 28 questions? Less than 50%. Most Americans have poor financial literacy, which often leads to lifelong financial troubles. But what is financial literacy, and how we can we teach it to a new generation of kids?

Jump to:

What is financial literacy for kids?

Put simply, financial literacy is the set of skills kids need to learn to help them manage money. While basic budgeting and saving skills are important, they’re just the tip of the iceberg. It’s also vital to understand more complex topics like investing, financial risk, and borrowing responsibly.

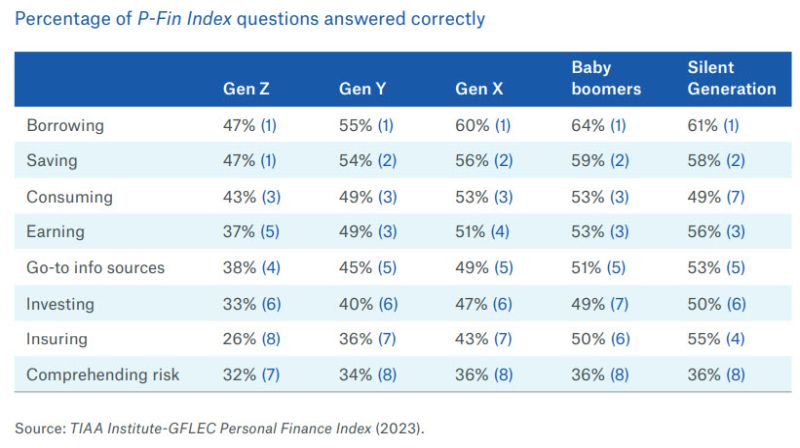

Financial literacy, like many important life skills, is impacted by age, race, and gender. While no age level did particularly well on The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) 2023 survey (the average score was 48%), younger generations fared worse. Gen Z scored lowest in seven of the eight categories (see below), earning an average score of 38%. Men scored better than women across the board, and Asians and Whites fared better than Blacks and Hispanics. Overall, the biggest area in which all Americans struggle is comprehending financial risk.

What specific financial literacy skills should kids learn?

According to GFLEC, we should aim for competency in eight areas. These are financial literacy topics we should teach kids in school.

- Earning: This refers to the amount of money you make and includes income from jobs as well as investments. Understanding earnings also means handling your taxes properly.

- Consuming (spending): Spending responsibly requires staying within your means. This is a major challenge for many Americans.

- Saving: Putting money away for the future could include savings accounts, CDs and other bank investments, and retirement accounts,

- Borrowing: Managing debt is another major challenge for many people. Debt includes any money you’ve borrowed, such as mortgages, car loans, or credit cards.

- Investing: This term generally refers to using your money to make more money. This can include interest-bearing savings accounts, but more often means investments in stocks, bonds, and mutual funds (the stock market). It could also mean investing money in a new business venture.

- Insuring: Insurance is how we protect our money and assets against future threats. You can insure cars, houses, personal property, and even your life.

- Comprehending risk: Financial risk is the possibility of losing money on an investment or business venture. Comprehending this risk involves using statistics and calculations to make an educated decision. This is one of the most challenging of financial skills for many.

- Finding financial advice: The average person is unlikely to have a deep knowledge of all these financial skills, which is why many people use financial advisors. However, it’s important to be able to find advisors you can trust, which is a financial skill in itself.

Some experts also include the ability to protect yourself against fraud and identify theft, which can cause major financial damage. Others include this concept as a part of comprehending risk.

How can I measure my own financial literacy?

Want to teach your students financial literacy but not sure if you understand it yourself? Measuring it doesn’t necessarily involve looking at your personal budget, debts, or other finances. Instead, it’s more about knowing how financial issues work, such as compounding interest, risk evaluation, and more.

You can get a good picture of your own knowledge by taking a test known as The Big Five. This five-question quiz was designed by economics professors as a quick and reliable way to judge financial understanding. Give it a try here.

Why is financial literacy so important for kids to learn?

Whether we like it or not, money really does seem to make the world go ’round. At the very least, everyone must be able to bring in enough money to support their needs and lifestyle. And while we don’t want to teach kids that money is the only thing that matters, we do know that making them financially literate can make their adult lives easier.

In 2023, adults with low financial literacy levels are four times more likely to have difficulty making ends meet, compared with those who have high financial understanding. They’re also four times less likely to have enough emergency savings to cover a month of expenses. And they’re almost three times as likely to have crippling debt issues.

The average American spends about 8 hours a week dealing with and thinking about financial issues. But those with higher financial skills drop that number to around 4 hours, while those without those skills average as much as 14 hours. That’s a big chunk of time, one most people would rather spend doing just about anything else.

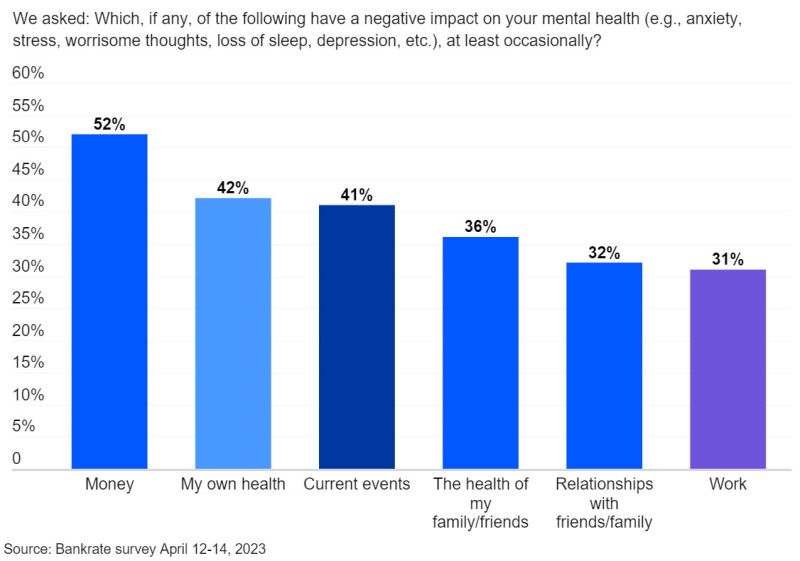

Money problems can have a serious impact on your mental health too. According to Debt.org, each additional $1,000 in credit card debt gives you a 4% higher chance of financial worry. In a 2023 Bankrate survey, respondents ranked money concerns as the largest contributor to stress. Fifty-two percent of people reported money as having a negative impact on their mental health.

It’s easy to see that good financial literacy skills are one of the most valuable gifts we can give today’s students.

How can we teach kids financial literacy skills?

We can start teaching students money skills at a young age. Even preschoolers can learn to understand that we need money to buy things, and we earn that money by going to work. As kids get older, they can tackle more concrete financial skills.

Financial Literacy Activities, Lesson Plans, and Classroom Resources

We Are Teachers has many resources to help teachers and parents tackle financial literacy with kids of all ages. Here are some to try: