Microsoft is running a new global marketing campaign in the 4Q24, dubbed, “This is an Xbox”, highlighting many consumer devices that it deems to be an Xbox. While this messaging reaffirms a shift in Microsoft’s strategy to attract Xbox users off-console, questions are raised over Microsoft’s readiness in the cloud, mobile, PC, and handheld segments.

Console contraction drives subscriptions saturation

Over ten years ago, Microsoft launched Xbox One, a singular device to drive Xbox’s ecosystem of games, software and services.

Fast forward to today, and Microsoft’s new “This is an Xbox” campaign attempts to raise consumer awareness that smartphones, laptops, TVs, handhelds, streaming sticks, and VR headsets are also Xboxes, de-emphasizing the console as the center of the Xbox ecosystem.

To understand how we got to this point, consider the following:

-

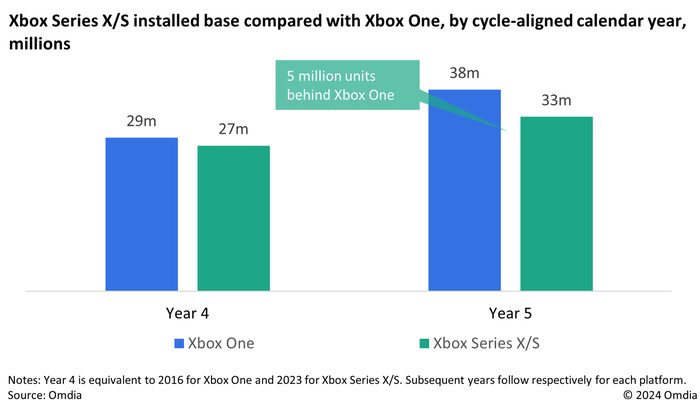

Xbox has endured two generations of console decline. As Xbox Series X/S ends its fifth calendar year on the market, Omdia’s Games Hardware Database estimates that its installed base will fall short of its Xbox One predecessor by 5m units (see Figure 1). This threatens the active installed base long-term.

-

Xbox’s content ecosystem has become subscriptions driven, impacting full game purchase revenues as key blockbuster games content sees day-and-date releases on the platform.

-

Game Pass subscriptions remain console-driven despite cloud offering. Omdia’s Game Subscriptions and Cloud Gaming Market Forecast reveals that the penetration rate of subscriptions for console-focused Game Pass tiers among active Xbox consoles will surpass 66% in 2024.

-

Microsoft is now the steward of valuable multi-platform content. Its $69bn acquisition of Activision Blizzard King gives it control of Call of Duty, World of Warcraft, and Candy Crush Saga, following its ownership of Bethesda series Fallout and Elder Scrolls.

These key events facilitate a situation where revenue from Xbox Game Pass has evidently not grown fast enough to offset the cannibalization of full game purchase revenue on Xbox consoles. This is why Microsoft begun releasing key first party games on competing consoles that it wouldn’t have dreamt of doing so previously.

Figure 1: Xbox Series X/S falls behind Xbox One by 5 million units at the same point in its cycle

Source: Omdia Games Hardware Database

There are big shifts happening, then, and the identity of the Xbox console – a loss leading box that earns its keep through software and services revenue – has been called into question. Add on top of this the decision to acquire significant content that is simply too costly to make exclusive to Xbox consoles and Microsoft has been forced into a position where it must look beyond its console audience.

Xbox is not ready to be unshackled from its console core

PCs are among the devices Microsoft is calling Xboxes, and it is here where Microsoft has the most potential to reach new players, as PC Game Pass offers access to high value first-party content such as 2024’s Call of Duty: Black Ops 6.

Omdia’s Game Subscriptions and Cloud Gaming Market Forecast estimates subscriptions to PC Game Pass at the end of 2024 will stand at under a sixth of all Game Pass tiers combined, so the platform represents plenty of potential for Microsoft to exploit.

Yet Microsoft remains in close competition with incumbent player Valve, whose Steam distribution platform is synonymous with PC gaming. While some major publishers such as Sega and Square Enix have begun publishing their Xbox console games on Microsoft’s PC storefront day-and-date, many remain content with Steam.

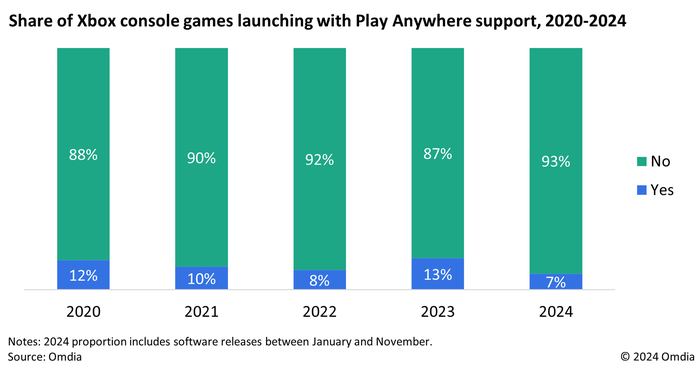

Omdia analysis of annual Xbox console game launches reveals that the bulk of titles continue to launch without an accompanying Xbox PC release via the Microsoft Store, as indicated by the lack of “Play Anywhere” support (see Figure 2).

Figure 2: Xbox console software continues to lack PC versions via Microsoft Store at launch

Source: Microsoft, Omdia

On mobile, Microsoft has also been keen to highlight smartphones as “an Xbox that makes calls”, yet the launch of an Xbox mobile store on Android is now off the table for 2024. This has left it without a means of directly engaging with its audience, standing in contrast with Epic Games, which has begun doing so with Fortnite and its recently launched Epic Games for Mobile.

PC gaming handhelds are another device that Microsoft also highlights as Xboxes. But the user experience is far from perfect – Windows 11’s poor user suitability for handhelds continues to hold back partnering PC manufacturers. Omdia’s Games Handhelds Database estimates Valve’s Steam Deck will continue leading this product category in global sell-through in 2024.

This leaves cloud streaming as the key means of turning devices like smartphones, tablets, and smart TVs into Xboxes. Yet cloud streaming also presents several hurdles:

-

Xbox Cloud Gaming continues to require the top tier Game Pass Ultimate subscription, making it a hard sell to anyone who doesn’t already own an Xbox console or gaming-capable PC. An ad-supported tier of Game Pass with a limited selection of games has yet to materialize.

-

Microsoft cannot guarantee a console-quality experience via cloud streaming. While Xbox console hardware is used in data centers to stream games to players, the resulting quality and latency of streamed gameplay depends on several factors outside Microsoft’s control. These include the location of Microsoft’s servers, the quality and type of connection, and the video codec used.

-

Additional friction remains. Games designed for large, 4K TVs aren’t guaranteed to look or play their best streamed to a small phone screen without a physical controller, which the audience off-console may not already own.

-

The full Xbox games library remains unavailable for streaming. This creates a mismatch of expectations, especially for lapsed or long-time Xbox console players who have invested in physical and digital console games that persist in the console library today.

-

Microsoft’s reach to customers on iPhones and iPads remains limited. Xbox Cloud Gaming continues to be unavailable on the iOS App Store. Apple’s core technology fee presents a tax on iOS users’ engagement that Microsoft has deemed not worth paying.

Put simply, the Xbox ecosystem off-console is not yet ready to shoulder Microsoft’s ambitions to truly grow off-console. On mobile, Microsoft lacks a distribution platform to build up long-term engagement with new customers. And while PC Game Pass shows the most promise, the lack of third-party support for the Microsoft Store re-affirms Steam’s dominance.

While cloud offers the most reach, it continues to present the same challenges to both Microsoft and consumers – many of the same challenges which hampered uptake at the beginning of Xbox Series X/S’s console cycle. In 4Q24, “This is an Xbox” ultimately presents a vision of where Microsoft would like Xbox to be, rather than where it is today.