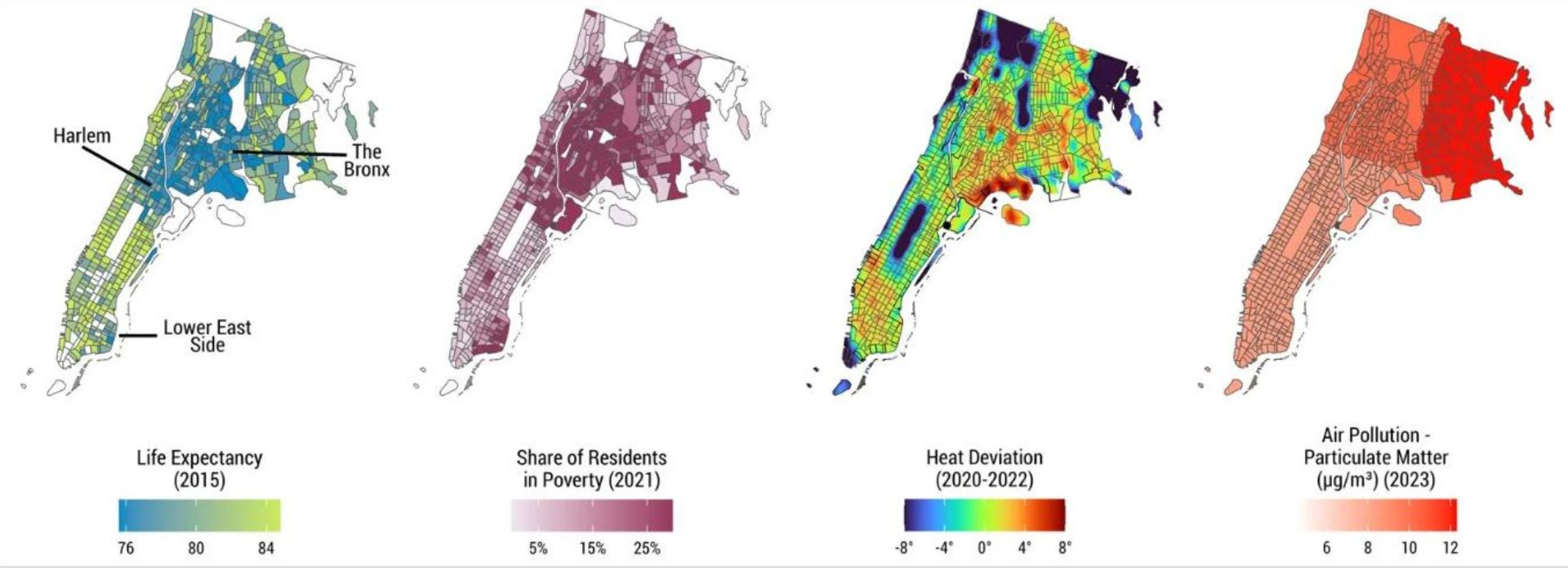

Maps are helpful navigation tools. They are equally valuable as historical snapshots. Take these maps of New York City, for example. As your eye scans the city outline from Lower Manhattan upward to the Bronx, you see indicators of lower life expectancy, poverty, and exposure to extreme heat and air pollution rise in the lower East Side, Harlem, and the Bronx.

This risk pattern is not random. These neighborhoods, home to concentrations of racial and ethnic populations and immigrants, have long legacies of disinvestment. They are also places at heightened risk from natural disasters.

New York City may be unique in many ways, but its maps showing the geography of climate, health, and economic vulnerability embody the dire situation facing communities across the United States. These communities are places where both the physical and human infrastructure have been hollowed out over time. They are also places where historic levels of public and private investment offer real potential for community-driven innovation and inclusive growth.

These maps of New York City show a pattern that is all too familiar: climate, health, and economic vulnerability overlap in the same places.

The geography of climate, health, and economic vulnerability in New York City

Practical solutions to support transforming energy systems and infrastructure

While these overlapping problems might seem intractable, the fact that they concentrate in neighborhoods presents an opportunity. For example, combining resources and ideas from those working on solutions in all three sectors can help communities overcome all three problems at once. And while joining forces from discrete workstreams may sound expensive and complicated, the reality is that states can save money in the process and unleash potential in underinvested places.

This integrated strategy for addressing climate, health, and economic vulnerabilities is more just, cost-effective, and efficient. It’s also healthier for people and better for the environment.

A new playbook outlines ways to get there.

What’s Possible: Investing Now for Prosperous, Sustainable Neighborhoods, published by the New York Fed, Enterprise Community Partners, and LISC, explores how governments, the private sector, and community leaders, together with thought leaders and civil society, can all contribute to the transformation of American communities. Using practical case studies, the text serves as a nationwide playbook for building a more resilient future without leaving millions of people behind.

There’s no better time than now to act

Groundbreaking new federal policies have created a platform for change and generated opportunities for banks, investors, businesses, community developers, and advocates alike. Now is the time to work together to build stronger, more resilient communities.

What’s Possible is a collection of essays exploring the intersection of community development and weather resilience.

Get your free copy of What’s Possible with complimentary shipping, and join us October 10 for a Connecting Communities webinar with several experts who contributed to the playbook. Subscribe to the Connecting Communities mailing list to receive notice of this event and other free webinars on community development topics.