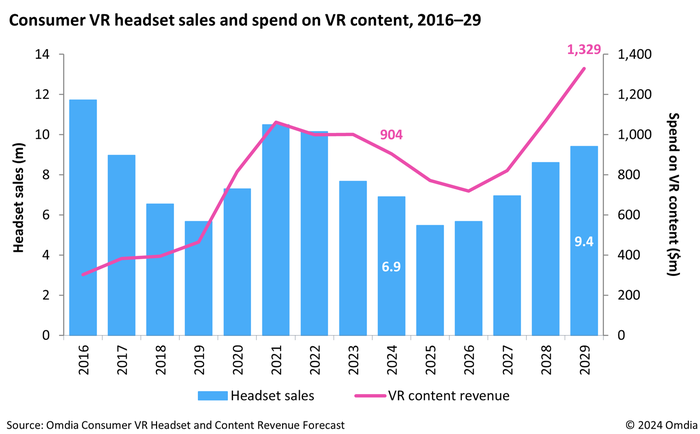

We recently published our latest consumer VR market research, showing that headset sales fell by 10% in 2024 to 6.9 million units, down from 7.7 million in 2023. The market is expected to decline further in 2025, in line with Omdia’s earlier projections. The outlook reflects a challenging period for the consumer VR industry ahead of a forecasted rebound in 2026. In this blog I lay out key drivers behind the downturn in 2024, as well as the factors driving the assumed growth in 2026 and beyond.

VR headset sales see two consecutive years of decline, following the pandemic-induced upswing

The consumer VR market continues to face significant challenges, with several indicators highlighting a lack of momentum and adoption. The highly anticipated Apple Vision Pro debut has failed to deliver the resurgence the industry hoped for, with limited developer enthusiasm and fading momentum ten months post-launch. Meanwhile, Meta’s recent entry-level Quest 3S has yet to spark a notable sales boost, as evidenced by my analysis of Black Friday headset sales across eight countries, which shows a 16% decline. PC VR adoption also remains stagnant, with Valve’s latest Hardware Survey revealing that only 1.5% of Steam users are engaging with VR hardware. Adding to this, Omdia’s supply chain insights confirm earlier reports of Sony halting PlayStation VR2 production due to unsold inventory, prompting the company to resort to heavy discounting to clear stock.

The challenges are further exacerbated in other markets and segments. VR headset sales in China have collapsed due to weak consumer demand, and the future of Pico remains uncertain following layoffs and restructuring by its parent company, ByteDance. The TikTok owner, which acquired Pico in 2021, appears to be losing interest in the segment. On the content side, developers are increasingly questioning the return on investment for VR games, with a recent Game Developer Collective survey revealing that half of respondents perceive the VR market as either stagnant or in decline.

The number of VR headsets in active use fell by 8% in 2024 to 21.9 million. This was primarily due to a low share of Quest 2 owners upgrading, over 20 million of which have been sold since 2020. Meanwhile, $904 million was spent on VR content in 2024; for context, games console content spend will generate $37.4 billion in 2024, highlighting the nascent nature of the consumer VR market. The current state of the VR market is characterized by waning consumer interest post-pandemic, a sluggish inflow of compelling new content, and growing skepticism among developers about the viability of VR as a profitable platform.

Growth is predicted to resume by 2026, but mass adoption of VR headsets in their current form remains unlikely

The expected return to growth in the VR market is heavily reliant on the anticipated launch of a more affordable Apple Vision Pro model in 2026, which is projected to drive the market expansion through 2029. Meta is also expected to remain a key player in the space, though its headset sales are likely to remain flat. Meta’s recent move to open its Horizon OS to third-party manufacturers underscores its continued commitment to VR, but the company faces an uphill battle. Meanwhile, Google’s announcement of the Android XR platform last week represents a much-needed competition in this space, but its history of launching and shortly shuttering new projects tempers expectations. Developer and manufacturer approach to these initiatives will be cautious, therefore, only incremental progress is anticipated in the short-term.

The form factor of current VR and passthrough mixed reality headsets remains a barrier to mass adoption. Consumer and manufacturer interest is shifting toward lightweight glasses, promising all-day, anywhere access to multimodal AI – as exemplified by Meta Ray-Ban glasses, which is seeing early signs of success. Companies in this space hope that this approach will help normalize face-based spatial computing, which could ultimately spur mass-market VR adoption. However, the progress towards achieving this will be slow, and isn’t expected to happen within this decade. In the near term, VR is likely to remain a niche market, constrained by its existing limitations and the growing industry focus on AR as the future of immersive technology.