Recent Trends in Real Estate Development (Spring 2024)By Frank MuracaPublished April 11, 2024

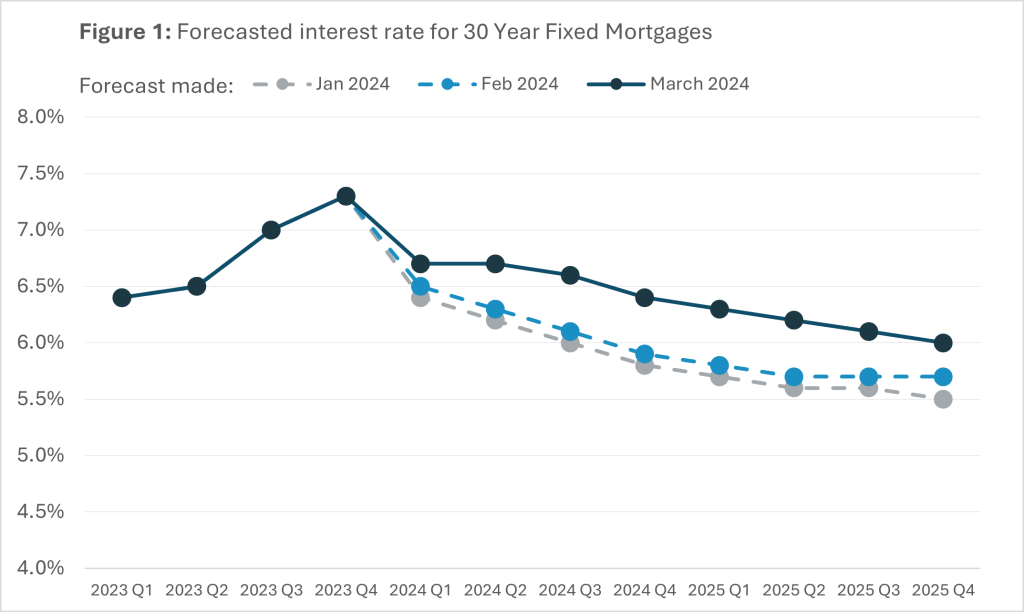

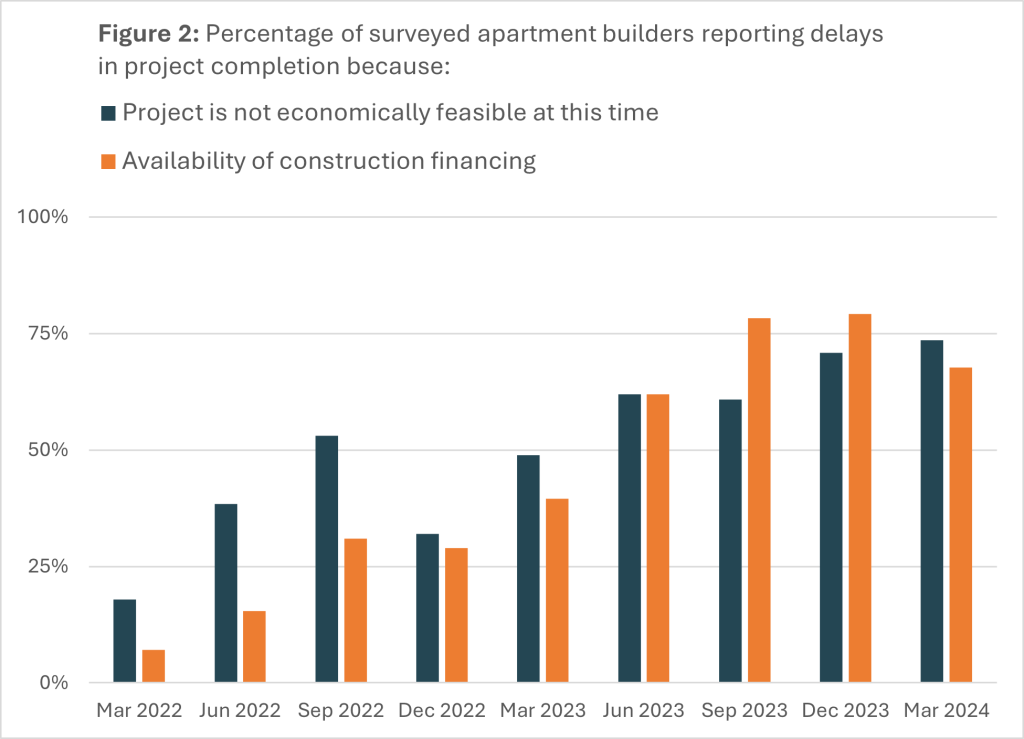

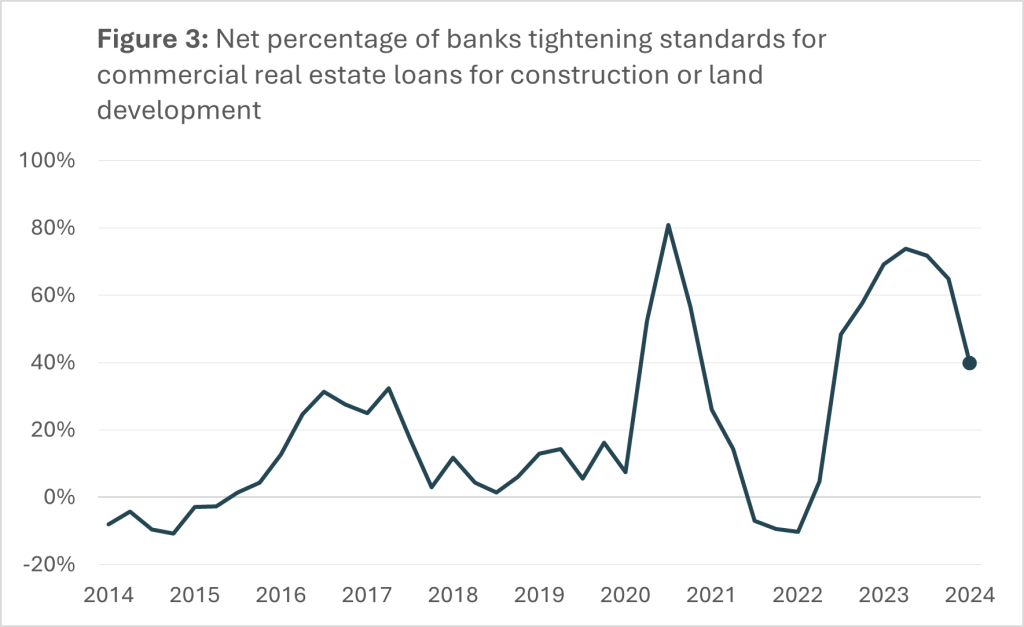

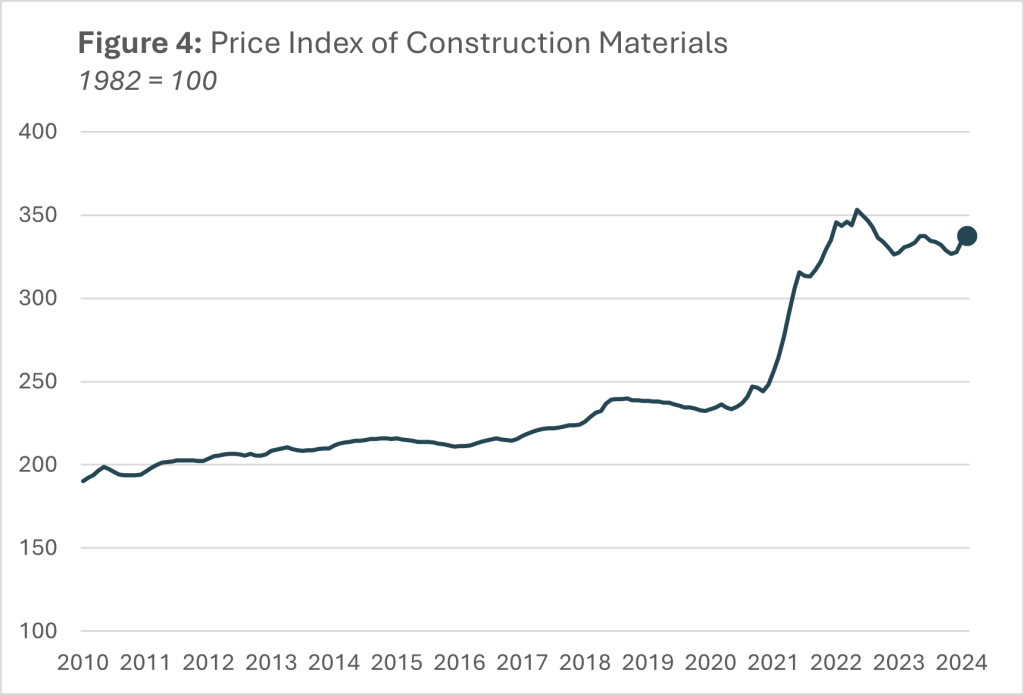

This blog post is part of a regular series on recent trends in private real estate financing. These posts are meant to inform local governments about current conditions facing private developers and real estate development projects in their communities. Lending for real estate development projectsTowards the end of 2023, some market watchers were cautiously optimistic that the Federal Reserve would begin to cut interest rates in 2024. However, stronger than expected inflation data has shifted those expectations over the past few months. In January, Fannie Mae forecasted that the interest rate on 30-Year Fixed Mortgages would drop below 6% by the end of 2024. But in their most recent forecast, Fannie Mae now expects interest rates to remain above 6% through the end of 2025. (Figure 1)  Developers continue to report challenges caused by high interest rates. For example, in September 2023, an affordable housing developer in Wilmington requested $1.25 million in additional gap funding from the city and county to help cover rising interest rate costs. According to one survey of the nation’s 30 leading apartment developers conducted by the National Multifamily Housing Council, 79% of those surveyed reported delays in starts for new projects.[1] Of those delays, 74% were because the project was not economically feasible in March 2024. For instance, Kane Realty – a commercial real estate development company – reported in December that future progress on the mixed-use “Downtown South” project in Raleigh is contingent on “interest rates going down”.  In September, the number of apartment builders that reported delays due to the availability of financing dropped from 79% to 68%, reflecting that lenders may be more willing to lend to projects than a few months ago. This trend is supported by other data showing that banks are beginning to loosen credit standards, making it easier for developers to borrow for new construction. Figure 3 shows survey response data from the Federal Reserve’s Senior Loan Officer Opinion Survey (or SLOOS). The survey asks banks whether they are tightening standards for commercial real estate loans used for construction or land development.  While the percentage of banks reporting tightened standards remains well above pre-COVID levels, it dropped from 75% to 40% over the past three quarters. According to another survey conducted by the National Multifamily Housing Council, 45% of CEOs of apartment-related firms reported that now was a better time to borrow for multifamily housing compared to just 3% in July 2023. Changes in construction costsIn addition to the availability of lending, the cost of building materials continues to be between 30% and 45% higher than pre-COVID prices. In January 2023, one construction company official told WBTV, “COVID really started really inflating prices for construction, for a lot of different materials and that was really the start of it, and now inflation after that has kept prices kind of high, so it’s been probably about 2-years now.” Even with recent reduced inflation, constructions costs have not declined to pre-COVID levels.[2] (Figure 4)

[1] Source: National Multifamily Housing Council. Quarterly Survey of Apartment Construction & Development Activity (September 2023). https://www.nmhc.org/research-insight/nmhc-construction-survey/2023/quarterly-survey-of-apartment-construction-development-activity-september-2023/ [2] St. Louis FRED Economic Data. Producer Price Index by Commodity: Special Indexes: Construction Materials. https://fred.stlouisfed.org/series/WPUSI012011

|

This blog post is part of a regular series on recent trends in private real estate financing. These posts are meant to inform local governments about current conditions facing private developers and real estate development projects in their communities.

Lending for real estate development projects

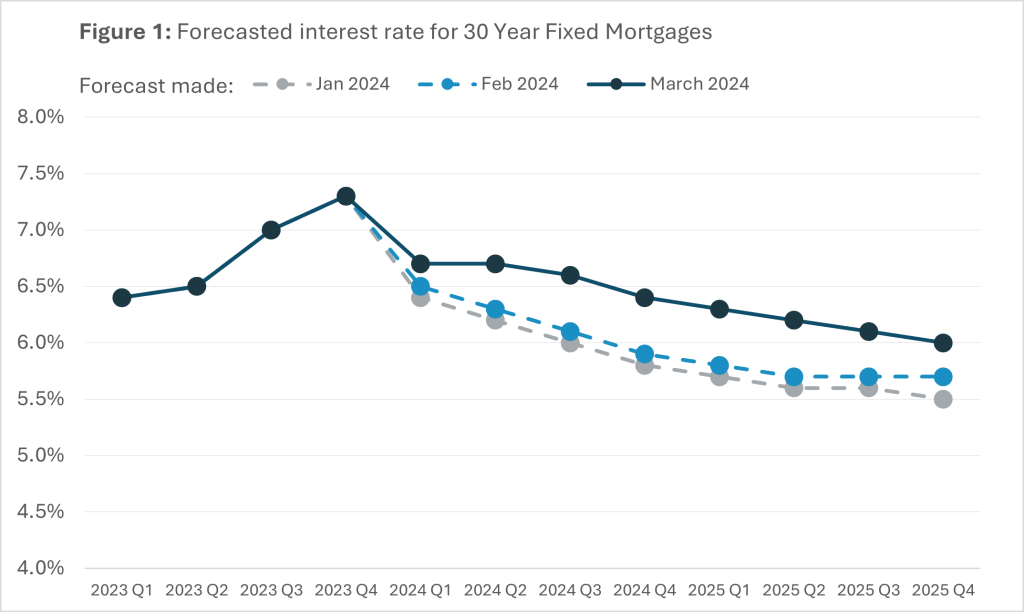

Towards the end of 2023, some market watchers were cautiously optimistic that the Federal Reserve would begin to cut interest rates in 2024. However, stronger than expected inflation data has shifted those expectations over the past few months. In January, Fannie Mae forecasted that the interest rate on 30-Year Fixed Mortgages would drop below 6% by the end of 2024. But in their most recent forecast, Fannie Mae now expects interest rates to remain above 6% through the end of 2025. (Figure 1)

Developers continue to report challenges caused by high interest rates. For example, in September 2023, an affordable housing developer in Wilmington requested $1.25 million in additional gap funding from the city and county to help cover rising interest rate costs.

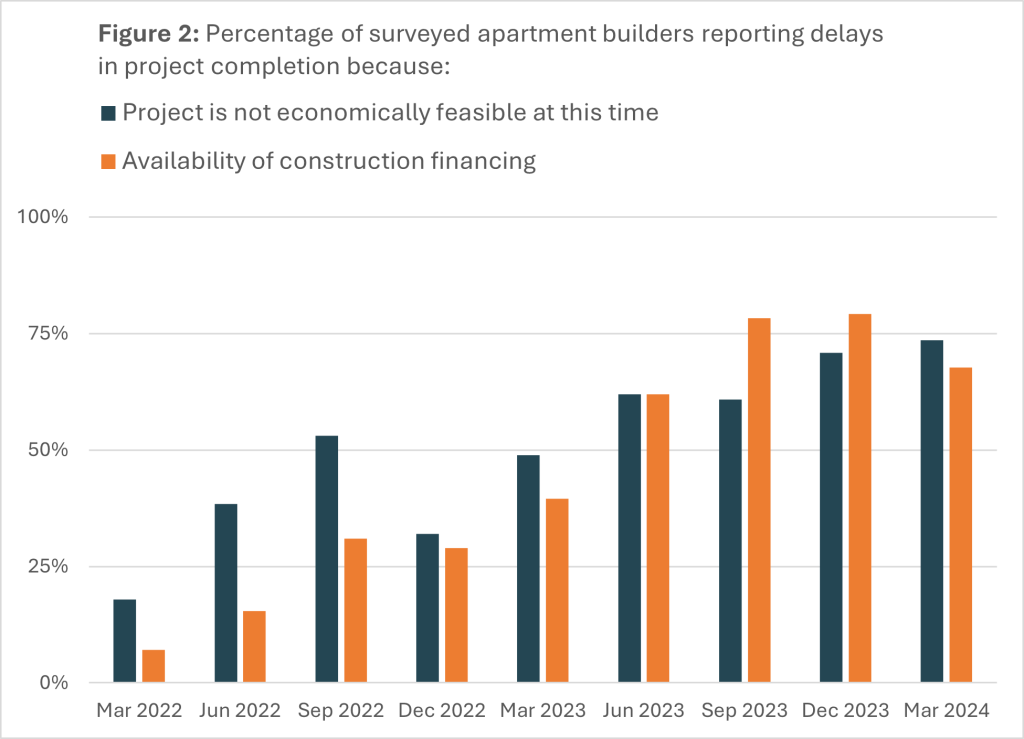

According to one survey of the nation’s 30 leading apartment developers conducted by the National Multifamily Housing Council, 79% of those surveyed reported delays in starts for new projects.[1] Of those delays, 74% were because the project was not economically feasible in March 2024. For instance, Kane Realty – a commercial real estate development company – reported in December that future progress on the mixed-use “Downtown South” project in Raleigh is contingent on “interest rates going down”.

In September, the number of apartment builders that reported delays due to the availability of financing dropped from 79% to 68%, reflecting that lenders may be more willing to lend to projects than a few months ago.

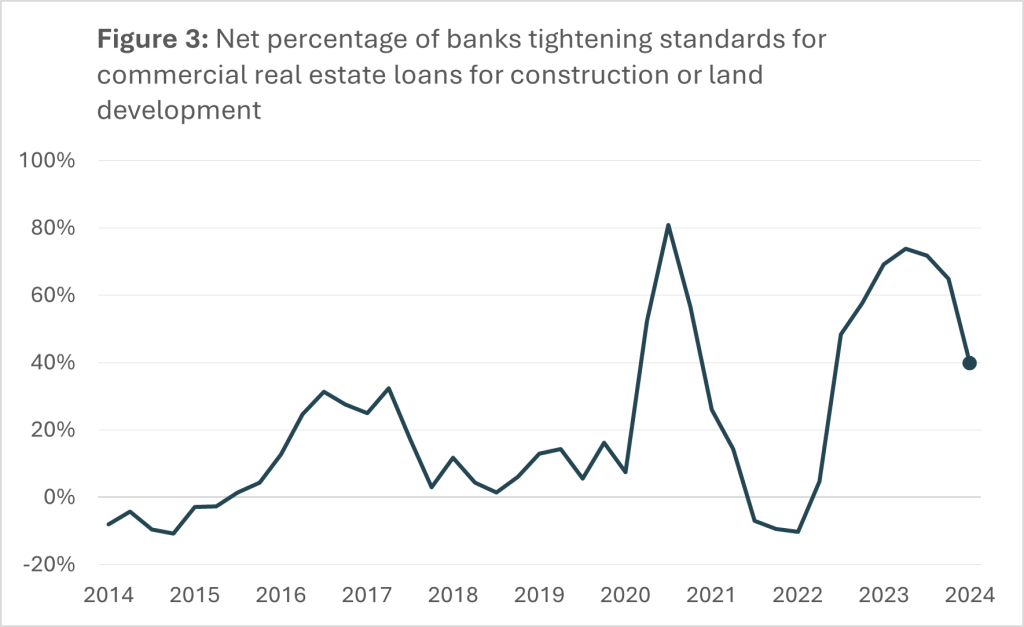

This trend is supported by other data showing that banks are beginning to loosen credit standards, making it easier for developers to borrow for new construction. Figure 3 shows survey response data from the Federal Reserve’s Senior Loan Officer Opinion Survey (or SLOOS). The survey asks banks whether they are tightening standards for commercial real estate loans used for construction or land development.

While the percentage of banks reporting tightened standards remains well above pre-COVID levels, it dropped from 75% to 40% over the past three quarters. According to another survey conducted by the National Multifamily Housing Council, 45% of CEOs of apartment-related firms reported that now was a better time to borrow for multifamily housing compared to just 3% in July 2023.

Changes in construction costs

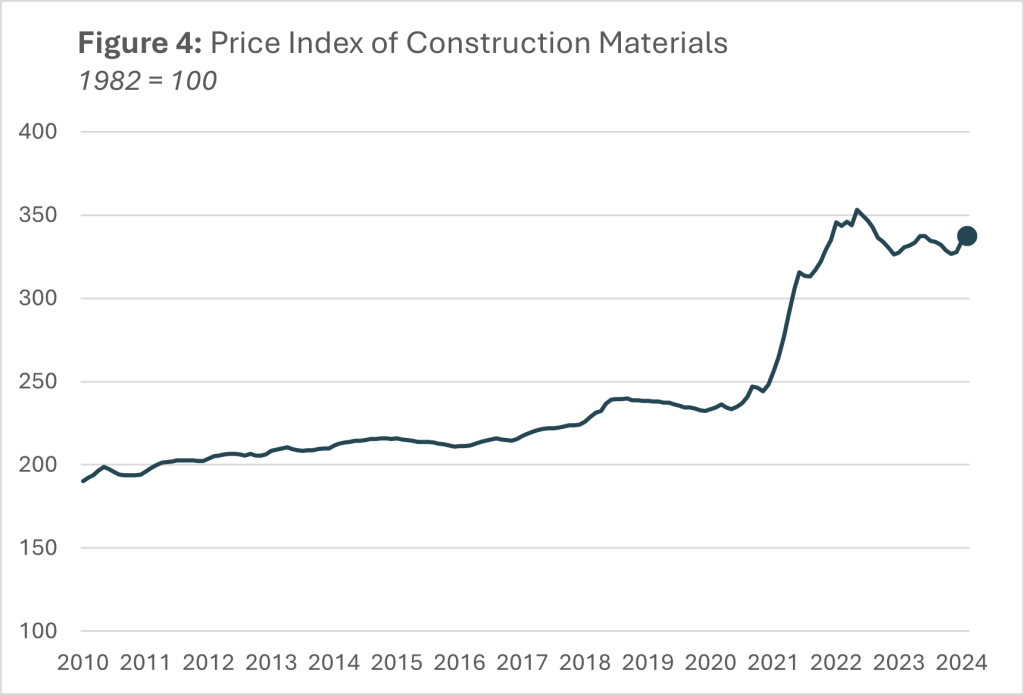

In addition to the availability of lending, the cost of building materials continues to be between 30% and 45% higher than pre-COVID prices. In January 2023, one construction company official told WBTV, “COVID really started really inflating prices for construction, for a lot of different materials and that was really the start of it, and now inflation after that has kept prices kind of high, so it’s been probably about 2-years now.” Even with recent reduced inflation, constructions costs have not declined to pre-COVID levels.[2] (Figure 4)

[1] Source: National Multifamily Housing Council. Quarterly Survey of Apartment Construction & Development Activity (September 2023). https://www.nmhc.org/research-insight/nmhc-construction-survey/2023/quarterly-survey-of-apartment-construction-development-activity-september-2023/

[2] St. Louis FRED Economic Data. Producer Price Index by Commodity: Special Indexes: Construction Materials. https://fred.stlouisfed.org/series/WPUSI012011

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved.

use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited.

To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of

Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax

919.962.2707.

Copyright © 2009 to Present School of Government at the University of North Carolina.